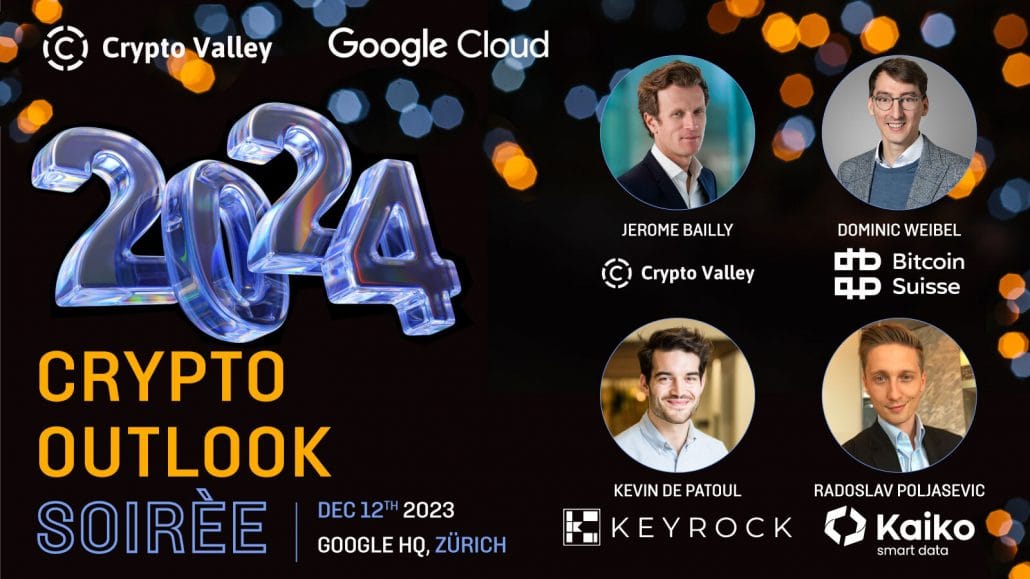

Last week, I attended the 2024 Crypto Outlook Soirée event at Google Zürich, organized by the Crypto Valley Association, sponsored by Google Cloud. Bitcoin Suisse Senior Research Analyst, Dominic Weibel, first gave a presentation which was followed by a panel discussion moderated by Jérôme Bailly whom I know from the early Magento days.

Dominic spoke about various aspects of the crypto market and its future. He began by comparing the crypto industry to an aircraft’s final assembly line, highlighting the coming together of various components after a long development period. Dominic’s background is in material science and aerospace engineering.

Key points included the high likelihood of a U.S. spot ETF (Exchange-Traded Fund) approval bringing legitimacy and access to Bitcoin, institutional demand indicators like the CME (Chicago Mercantile Exchange) flip and Coinbase’s performance, and Bitcoin’s role in diversified portfolios.

Dominic also mentioned potential adoption drivers like gaming, betting, and risk mitigation, and anticipates significant wealth transfer from baby boomers to more crypto-savvy millennials. Additionally, supply constraints and the impact of the halving (Bitcoin mining reward cut in half) were addressed, with an expectation of a supply squeeze. He concluded with the potential challenges like macroeconomic turmoil and regulatory pressures, emphasizing that price is a lagging indicator of fundamental technology values.

Bitcoin Suisse Crypto Outlook for 2024

Since yesterday, the 2024 Crypto Outlook report presented by Dominic is available for free from the Bitcoin Suisse website. The 70 page document provides in-depth industry insights into markets, technology and regulation. Albeit this blog post’s catchy title, the report was not only written by former aerospace engineer Dominic, but also by four other analysts and researchers.

Watch the exclusive launch session with Bitcoin Suisse chairman Luzius Meisser, Head of Research Dr. Marcus Dapp, Chief Clients Officer Lothar Cerjak as well as a conversation on the crypto market and developments between Dominic Weibel and Leeor Groen, Managing Director at Spartan Group.

You’ll also find a brief summary below.

Market Projections and Key Crypto Ecosystems

The «Crypto Outlook 2024» report offers a detailed analysis of the crypto market’s future, particularly focusing on Bitcoin and Ethereum. It discusses how macroeconomic factors, liquidity conditions, and market dynamics might impact these digital assets. The report predicts the market capitalization of cryptocurrencies, providing price forecasts for Bitcoin and Ethereum, and delves into the potential influence of Bitcoin’s 2024 halving event and the introduction of Bitcoin spot ETFs in the U.S.

Global Economic Influence on Crypto

Furthermore, the report explores the global monetary landscape and its effects on the crypto market. It analyzes various economic conditions that could influence the adoption and valuation of cryptocurrencies. The anticipated growth of the crypto market is supported by data-driven insights, combining empirical research with expert predictions.

Environmental Aspects of Bitcoin Mining

Lastly, the report examines environmental concerns related to Bitcoin mining, discussing its potential role in climate change mitigation and sustainability. It considers Bitcoin’s utility as an eco-friendly investment, highlighting how technological advancements in mining could enhance its sustainability profile. This section is particularly relevant in the context of growing environmental consciousness among investors and stakeholders.

So, to wrap up the «Crypto Outlook 2024» report: It’s like peering into a crystal ball, but instead of mystical fortunes, it’s all about Bitcoin and Ethereum’s ups and downs. Remember, this isn’t your financial guru’s crystal ball – it’s just a glimpse into a possible future, not investment advice. As we get closer to Bitcoin’s big party (aka the halving) and possibly welcome Bitcoin spot ETFs, it’s an exciting time in Cryptoland. Stay tuned, stay informed, and maybe don’t bet your grandma’s heirlooms on it!

Credits

- Pictures by Nick Weisser shared under a Creative Commons license, which means you can use them freely, if you give appropriate credit