Revolutions take time.

Michael Fasanello

Today, the European Blockchain Convention opened its doors for the 8th time in Barcelona. It features over 200 speakers across a variety of panels, keynotes, workshops and fire-side chats on the current state of blockchain, crypto, DeFi, NFTs, and Web3.

For me the event started with an interesting discussion about how to keep your crypto safe. One of the most important concepts for holding crypto currency is:

Not your keys, not your coins.

Andreas Antonopoulos

Some sources attribute this phrase to Andreas Antonopoulos, a well-known Bitcoin advocate and author, who used it in his book «Mastering Bitcoin» published in 2014. Others believe that the phrase was first used on the Bitcointalk forum or in other online communities as early as 2013.

It expresses the belief that you cannot be certain of your crypto holdings unless they are stored in a wallet for which you personally have the so called private key. Crypto exchanges like FTX usually hold onto users’ wallets and keys for them, meaning that for accessing your crypto you’re dependent on the exchange. If the exchange goes bust, your crypto is gone.

First panel @EBlockchainCon: How to keep your #crypto safe with with @bitmarkets_com's Maria Apogeni, @clarisse_hagege and @AegisCustody's Serra Wei. #EBC23 #blockchain #web3 pic.twitter.com/laNYkcaXr5

— Nick Weisser (@nickweisser) February 16, 2023

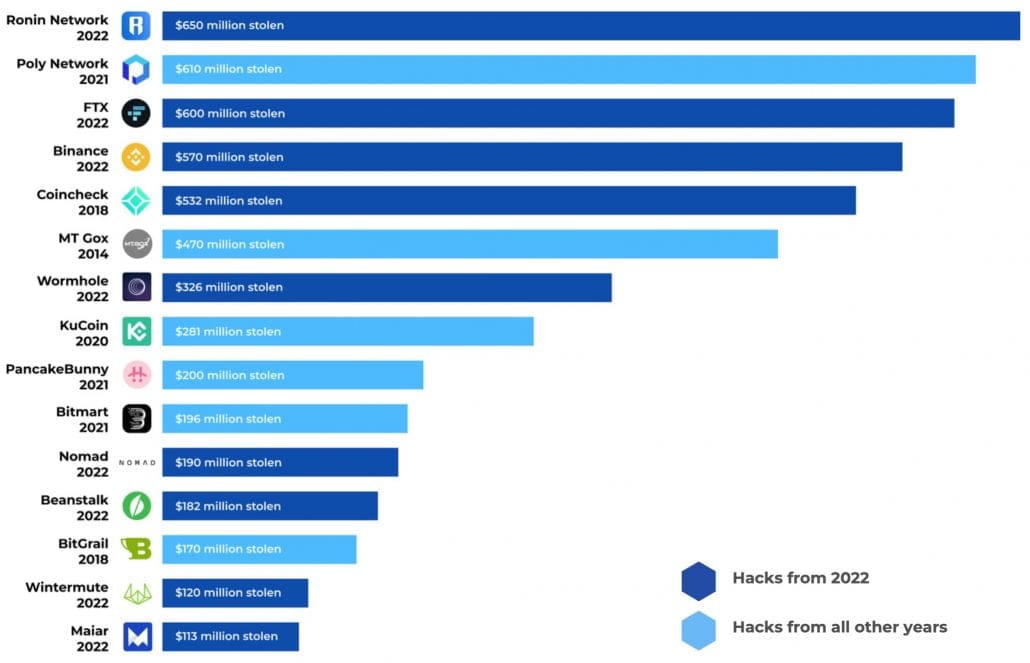

According to AnChain.AI of the top 15 crypto hacks of all time by value stolen in USD, 9 took place in 2022.

Regulation must be properly scoped. And again, in order to fuel that, we need to educate. Mitigating risk and abuse, securing assets. We’ve got the SEC (U.S. Securities and Exchange Commission) now coming out and attacking the lending platforms, stablecoins, staking. And it’s interesting because Gary Gensler taught at MIT (Massachusetts Institute of Technology). He is a blockchain specialist.

So we have somebody who’s actually the head of the SEC putting out these overly broad and overly scoped regulations. While they understand very well what the technology does and how it operates. So to me, it’s largely a power play in governments where they understand that this is not only a threat to the traditional system of finance, but also to their control over the civilian populations.

Michael Fasanello, AnChain.AI’s Chief Compliance Officer

In 2020, @Bl0ckchainMike pivoted to digital assets and never looked back. He's now working for #AI-powered #cybersecurity company @AnChainAI enhancing #Web3 security and risk management. #EBC23 pic.twitter.com/t5qtbX9KqD

— Nick Weisser (@nickweisser) February 16, 2023

You can find the audio recording of Michael’s keynote and the full transcript below. Here are some other topics from the first day of the European Blockchain Convention:

- Building infrastructure for institutional crypto adoption

- Why market making is key for a crypto market recovery

- How to bring 1 billion users to decentralized finance?

- Web3 will change privacy as we know it

- What if Warren Buffet did crypto?

- Web3 & Crypto: Building trust in digital finance

- The impact of the Metaverse on Society

- Integrating security into smart contracts

- What’s next after the FTX crash?

- The staking economy

- Restoring trust in the crypto industry

- Building trust and transparency in digital assets

- Building trust in Web3: An opportunity for Europe’s sovereignty

- Essential infrastructure for crypto enterprises, institutions and DAOs

- Building Web3

- Is Crypto still attracting institutional money?

- Top crypto predictions to watch out for in 2023

Audio Recording

Transcript

I don’t blame folks for leaving. I’m getting hungry myself. So if you have to go to lunch, feel free to. All right. So I did a dry run last night and it ran about 20 minutes. And that’s what happens when you give a lawyer a microphone, they’ll talk forever. So, anyway, thank you for being here and for coming to hear the talk on safeguarding the financial revolution. It’s a little bit odd sometimes to start a speech with a thank you, but I thought that it was appropriate after the chaos that was 2022 to thank all of you for being here and also to thank European Blockchain Convention for doing everything that you do for the space. You guys are all the beating heart of this industry and we just really needed it after last year. AnChain.AI where I’m crypto compliance officer, we released a Web3 risk annual report that showed 4 billion in exploits last year alone, which actually amounted to if you looked at the exploits by highest dollar value in all of blockchain history, 60% of them nine out of the top 15 happened in 2022. We also know that there were some unfortunate incidents largely unrelated to the technology itself, mostly to the sins of the human being, the sins of the flesh, if you would. So it was a very rough year, and I thought it was appropriate to to start out by just thanking everybody for being here and keeping this beautiful thing going. Thank you. And I would be remiss not to mention that it’s also very close to my heart that I’m back in Barcelona after 20 years.

The last time I was here was in high school with a Spanish trip unsanctioned by the school itself. But our professors were beautiful enough to want to immerse us in the culture and the language while learning the language. And so being back here in Barcelona to give a speech on such a topic of passion for me is also another beautiful thing. So I thought that these were worth noting for you.

Before we get to the absolute fun, that is regulation compliance. Just a little bit about myself. Michael Fasanello again, crypto compliance officer for AnChain.AI. I, I spent ten years working in the public sector in the United States with the Departments of Treasury and Department of Justice. With Justice. I was with the asset forfeiture and money laundering section of the Criminal Division in Washington DC. Handled a lot of asset forfeiture and money laundering, litigation cases, case management, support for the (?) and things like that. I bounced around the civil division for a little bit. I was at the Solicitor General’s office, which, if you’re not familiar with the United States, is where the government positions its lawyers to argue before the Supreme Court. So that was a very interesting role. With Treasury, I was with the Office of Foreign Assets Control handling sanctions, licensing cases and policy, legal interpretation, enforcement actions, and a little bit of support for their intelligence unit. And then I rounded that off with a stint at FinCEN Financial Crimes Enforcement Network Handling Bank Secrecy Act and other illicit finance regulation, development policy development advisory and training them, the training of the other Departments and the Treasury. Then after governments, I went to Bittrex very briefly. Only about a month there, the family relocated to Pittsburgh and so I was leaving the DC area sooner than I expected. But Bittrex was where I really caught the hook for incorporating compliance with Web3 and with blockchain into my career. Sadly, I was working again only for a month, but then I went over to traditional finance for a little bit. PNC Bank and First National Bank to two large domestic institutions in the United States, where it reminded me how very boring traditional finance could be. So I wanted to get back into Web3 and after leaving PNC Bank, I worked with a firm called Blockchain Intelligence Group, which offered me a course which enabled me to learn everything that I could. 0 to 60 basically on blockchain, cryptocurrencies, digital assets and the like after blockchain. And so I worked for a hybrid financial institution, Neobank and also crypto exchange called Level, as chief compliance officer there. And then most recently AnChain.AI picked me up and now I’m handling everything, all these different hats from policy enhancements to products, legal interpretation and of course training and speaking to large audiences. So a little bit about AnChain.AI, we were founded in 2018. We are a Wall Street and Silicon Valley venture capital funded cybersecurity and risk management firm. AI-powered, of course, as is in the name. We were a CNBC top Startups for Enterprise Award winner in 2022 and we were selected for the Berkeley Blockchain Accelerator.

We’re regularly featured by tech media and journalism, and our co founders, Victor and Ben, were from (?). So blockchain is a revolution in finance as we know, and it’s important that revolutions like this are safeguarded properly. We’ve seen over the past weeks, months and even years the overly broad application of current regulations that don’t often fit the way they should with our industry versus traditional finance. We’ve seen legislation come out around the world where legislators are not properly educated on the technology and the participants themselves. So how do you regulate something that you don’t understand? So a lot of what we do now at AnChain, besides providing products and services to provide security and risk management, is also to educate. I like to say regulation through education. So regulations take time. I’m sorry. Revolutions take time. You know, think about electricity, cars, even the Internet. You can go on Google and find snapshots of newspapers where people mocked the Internet. There’s just the fact there’s just a passing fad thinking things weren’t going to work out with it. Electricity. You can find cartoons of people mocking electricity back in the day. And as we know, these are very, very critical to today’s way of life. So I see the same thing in blockchain. We’re being attacked from all angles. People are scared of blockchain and crypto. They don’t understand it. They mock us. They say there is too much access to illicit finance and money laundering and terrorism and all that stuff. But it’s also a beautiful thing because there is real time access to payments that have this faster than ever before cross-border.

You don’t have to carry pounds of currency with you. You don’t have to wait several days for a wire transfer to be settled. So there’s a lot of beauty in this space. And I think that it’s it’s our responsibility to take that message everywhere we go with this other wise, what are we doing here? Right. You want to you want to spend your time on things that you’re passionate about. So revolutions do take time. Regulations, of course, it’s kind of a dirty word, and specifically in DeFi, but in in digital assets, a lot of people don’t like to talk about compliance. They don’t like to talk about regulation. And I understand that. And as somebody who’s, you know, I’ve been in the government, I’ve seen what happens on that side of things. I’ve always been very suspect of it. But at the same time, you know, there’s a certain amount of regulation that lends credibility and trust and does to a degree mitigate risk. I think this morning one of the speakers in their keynotes said we’re never going to get rid of illicit finance, we’re never going to get rid of crime in this ecosystem. And that’s true. But, you know, we’re never going to get rid of that in Fiat either. So how is it different for us in crypto, other than it being a new form of technology that people are scared of? So the properly scoped regulations will encourage that adoption that we’ve been looking for.

Regulators must be informed again, talked about a little bit the fundamental misunderstanding of this technology. Elizabeth Warren and a couple of other senators in the United States. As a knee jerk reaction to the FTX crisis, they issued a proposed law for the Digital Assets Anti-Money Laundering Act, which is one of the most aggressive adverse actions taken as a threat against unhosted wallets and self custody that I’ve ever seen. And this is not the first time that Congress has released a proposed law that is overly broad. It covers parties that have no way of complying with those regulations should they ever be passed. And so it’s just a prime example of the need for education in order to have proper regulation.

Lastly, regulation must be properly scoped. And again, in order to fuel that, we need to educate. So I think we’ve covered a couple of these points. Mitigating risk and abuse, securing assets. Yeah. I mean, it’s a strange time. We’ve got the SEC now coming out and attacking the lending platforms, stablecoins, staking all these things that if they understood. And it’s interesting because Gary Gensler taught at MIT, right? He is a blockchain specialist. So we have somebody who’s actually the head of the SEC putting out these overly broad and overly scoped regulations. While they understand very well what the technology does and how it operates. So to me, it’s largely a power play in governments where they understand that this is not only a threat to the traditional system of finance, but also to their control over the civilian populations.

And so it’s important that we have associations that could step up and be (?). We just had a meeting shortly before my talk here with a with an organization representing blockchain in Europe. And so it’s important that the industry can stand up and actually speak for the technology and for the participants in the event that the regulators, even the ones that are educated, decide to act sort of outside the scope of what would be appropriate for this for the space. Regulation must be properly scoped again. You know, when you’re dealing with different assets, different parties, platforms and use cases with assets, are we talking about coins, contracts, tokens, etc.? Are we talking about developers, miners, stakers, validators, platforms? How about custodians, exchanges, market makers, and then use cases? We know crypto itself can be a commodity, it can be a currency. It can be a security, according to the SEC. Every other day they tell us that. So it’s just really important that we properly scoped these regulations to fit the parties as they should. A miner, a validator very difficult for them to comply with regulations, asking for the divulging of KYC information. And how does one do that? Right. So thank you very much. We are the new blood of the global revolution in finance. And again, thank you all for keeping its heart beating after 2022. Thanks for listening to the talk on on how regulation and compliance can help safeguard this beautiful space. I appreciate it.

Credits and Related Content

- The Metaverse – A $1 Trillion Revenue Opportunity? #EBC22 Part 1

- But, what’s the Use Case of Blockchain? #EBC22 Part 2

- Beitragsbild von Nick Weisser